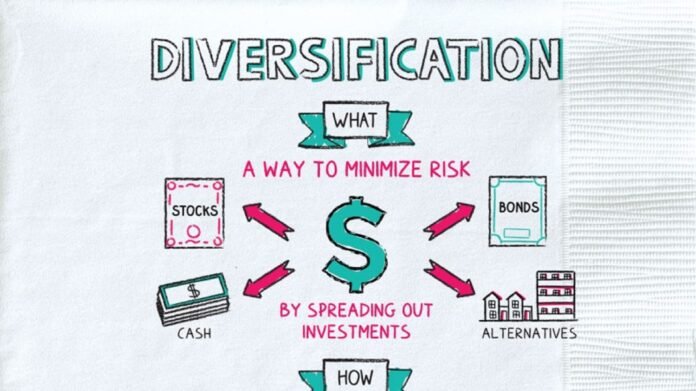

Investing in financial markets comes with inherent risks, but there are strategies to mitigate those risks and increase the chances of achieving favorable returns. One such strategy is diversification, which involves spreading investments across different asset classes, sectors, and regions. In this article, we explore the importance of diversification in building a robust investment portfolio.

Diversification plays a crucial role in risk management within an investment portfolio. By allocating investments across various asset classes such as stocks, bonds, real estate, and commodities, investors can reduce the impact of volatility in any single investment. Diversification helps to ensure that losses in one investment can be offset by gains in another, thereby minimizing the overall risk.

One key aspect of portfolio diversification is asset allocation. Investors should consider their risk tolerance, investment goals, and time horizon to determine the appropriate mix of assets. A well-diversified portfolio typically includes a combination of high-risk and low-risk investments, balancing potential returns with risk exposure.

Regular portfolio rebalancing is essential to maintain diversification. As different asset classes perform differently over time, the initial allocation can shift, leading to an imbalance in the portfolio. Rebalancing involves selling overperforming assets and reallocating funds to underperforming ones, ensuring the portfolio remains aligned with the desired asset allocation.

Diversification offers several benefits. It helps protect the portfolio against market downturns, as losses in one investment may be offset by gains in others. Diversified portfolios also have the potential to provide more consistent returns over the long term, as they are not solely reliant on the performance of a single investment.

Investors should also consider diversifying across sectors and regions. By investing in a mix of industries and geographical locations, investors can further spread their risk. This approach reduces exposure to specific industry or regional risks and allows for participation in various growth opportunities.

Diversification is a fundamental principle of investment portfolio management. By spreading risk across different asset classes, sectors, and regions, investors can reduce the impact of market volatility and increase the likelihood of achieving their investment goals. Maintaining a well-diversified portfolio requires regular review, asset allocation adjustments, and periodic rebalancing. By understanding the importance of diversification and implementing a robust investment strategy, individuals can navigate the financial markets with greater confidence and improve their long-term investment outcomes.