Retirement planning is a crucial aspect of financial management that enables individuals to secure a financially stable future. It involves setting goals, making strategic investments, and implementing effective savings strategies to ensure a comfortable retirement. In this article, we explore the importance of retirement planning and provide insights on how individuals can achieve financial security in their golden years.

Retirement planning starts with setting clear financial goals for the future. It involves assessing current financial resources, estimating future expenses, and determining the desired lifestyle during retirement. By creating a comprehensive retirement plan, individuals can gain a clearer understanding of the savings and investment strategies needed to achieve their goals.

One of the primary considerations in retirement planning is building a retirement savings portfolio. This involves contributing regularly to retirement accounts such as 401(k)s, individual retirement accounts (IRAs), or employer-sponsored pension plans. Individuals should take advantage of employer matching contributions and explore tax-efficient investment options to maximize their savings potential.

Understanding Social Security benefits is another crucial aspect of retirement planning. Individuals need to familiarize themselves with the eligibility criteria, projected benefits, and potential strategies for optimizing their Social Security income. Incorporating these benefits into their retirement plan can provide a valuable source of income during retirement.

Investment strategies play a vital role in retirement planning as they help individuals grow their savings over time. Diversification, asset allocation, and risk management are key principles to consider when designing an investment portfolio. Seeking professional financial advice can help individuals make informed investment decisions aligned with their retirement goals.

Long-term financial planning is essential for maintaining financial stability throughout retirement. This includes creating a budget, managing debt, and planning for healthcare costs. Individuals should also consider estate planning to ensure their assets are protected and properly distributed according to their wishes.

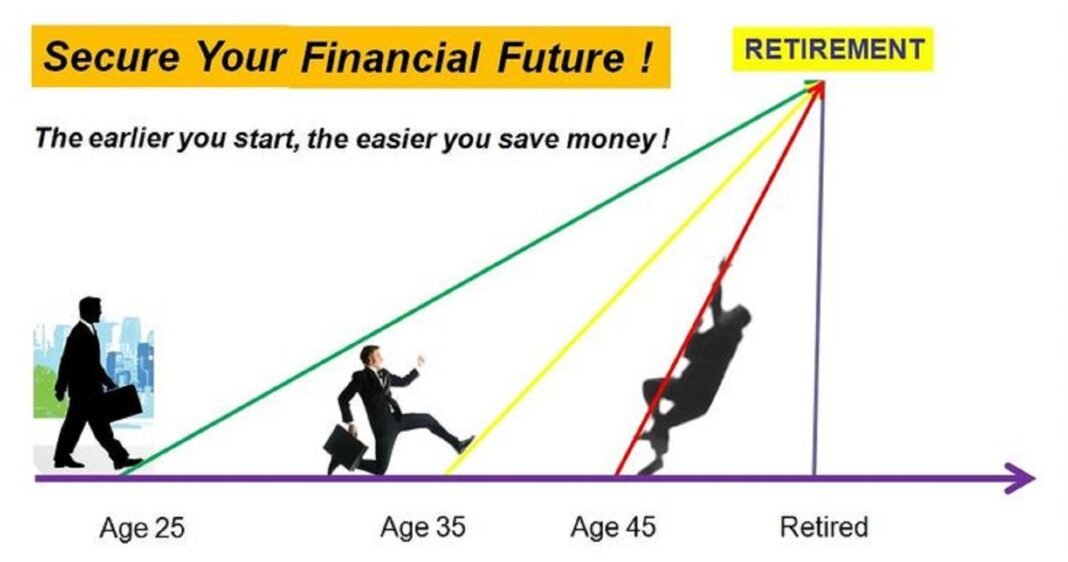

Retirement planning is a proactive approach to secure a financially stable future. By setting clear goals, saving diligently, and making smart investment decisions, individuals can build a solid foundation for retirement. It is crucial to start planning early and regularly review and adjust the retirement plan to adapt to changing circumstances. With careful financial management and a comprehensive retirement strategy, individuals can enjoy a comfortable and worry-free retirement.